Financial Planning for the Longterm

Comprehensive Financial Planning

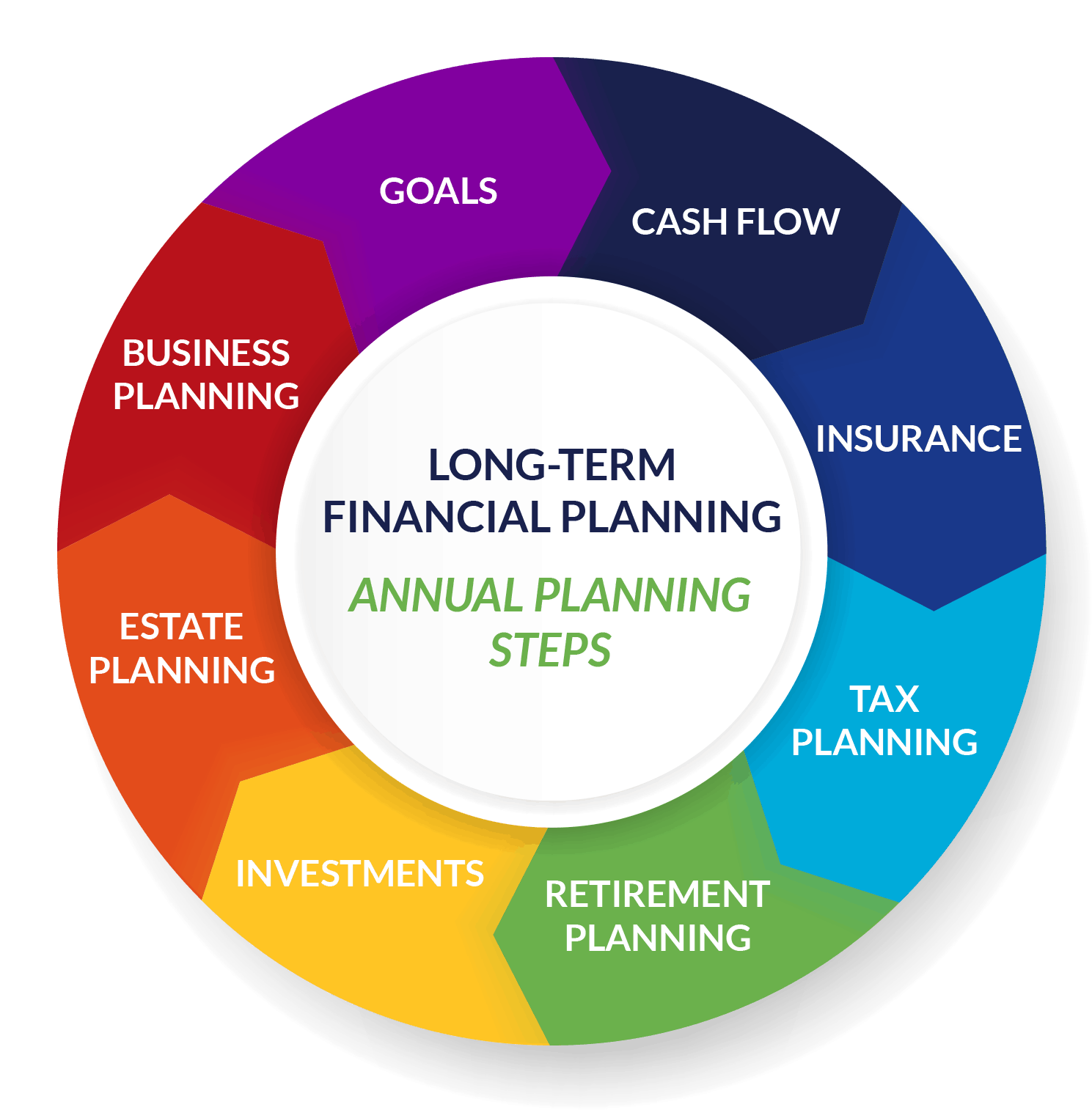

As a comprehensive financial planning firm, we take a holistic, all-or-nothing approach to helping people develop a financial plan that is as unique as they are. When you engage one of our firm's Financial Advisors for the longterm, we act as an ongoing coach and resource for all aspects of your finances.

Your goals.

We want to know what's important about money to you? What do you want to do with your wealth?

Your existing financial status.

We will ask you to complete our firm's Personal Financial Fact Finder because there are several components to a person’s financial situation and we want to ensure we've taken every step possible to include those.

Analyze and evaluate what you currently have in place.

We are not "Brokers", therefore, if your existing investments and planning strategies are suitable based on the information you're providing, we will be the first to tell you. If we see areas that you might consider making changes to, we will make recommendations.

Develop a plan that works towards achieving your goals.

Our financial plans are 100% designed with our clients in mind. Your goals and dreams are going to vary from another and you need a financial plan that is designed specifically to achieve those goals.

Evaluate your risks.

You've worked hard to accumulate your assets, protecting them is a critical component. We will discuss insurance needs, coverage as well as level of risk tolerance when it comes to investing. We will help you evaluate your risks and allow you to tell us how comfortable assuming risk you are within your portfolio.

Estate Planning.

We will discuss your estate planning needs in depth with you from a financial planning standpoint and we are happy to work with your attorney or make a recommendation if you are not presently working with one.

Tax Planning.

Taxes are complex and controllable... to an extent. Effective tax planning is something we like to review with our clients annually at least. We want to ensure that you are informed of changes in tax laws that could impact you and that when it comes to implementing your financial plan that you are being tax wise.

Monitoring.

Once your financial plan is developed it needs to be monitored and maybe even, from time to time, adjusted. We like to meet with our clients no less than four times a year for this reason. Life happens, times change, we need to ensure that we are making adjustments and staying the course when needed.

Have a Specific Question You Would Like Answered During Your Appointment?

Submit your questions now using the form below. Your Financial Planner will review your questions prior to your consultation.